The way we work is in a constant state of change. In order to remain innovative, profitable, and future-proof – and above all, to continue to be attractive to employees, “New Work” is no longer just a fad or a trend for employers. In today’s world, it has become a necessity. It is clear that the needs and desires of employees are shifting away from the simple completion of tasks. Instead, more and more workers want to make a real difference with their occupations, all the while exploring their creativity and optimizing their potential. Moreover, work-life balance is playing an increasingly important role. Among other things, this is reflected in the fact that employees can now select the working environment that best meets their wishes and needs. Remote work, co-working spaces, and open-plan offices are now very much the norm.

For insurers, this means that current and future employees will not only request, but also expect remote or hybrid work situations. In particular, the requirements and expectations of claims processors are evolving. Claims processing is increasingly moving away from routine data entry and “mass” processing to specialized processing and customized resolutions.

In order to accommodate this change, modern digital tools are needed in addition to the required organizational and personnel measures. On the one hand, claims automation must be advanced enough to eliminate the manual processing of “simple” customer claims, and to ensure the insurance company maintains a high level of efficiency. At the same time, processors must be supported in their new way of working with intuitive interfaces – and above all, with access to customized information.

Comprehensive mapping of customer processes

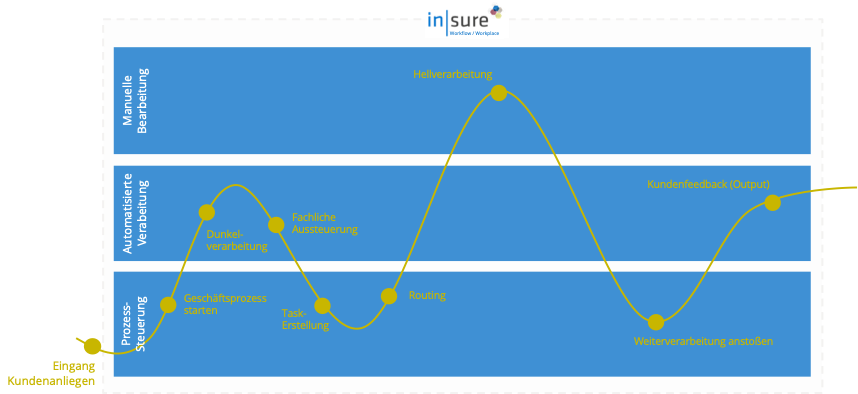

In order to provide optimal support for modern claims processing systems, the processes for handling customer claims must be (digitally) mapped in their entirety. This support will vary for fully automated processes (straight through processing), partially automated processes, and fully manual processes (“light” processing).

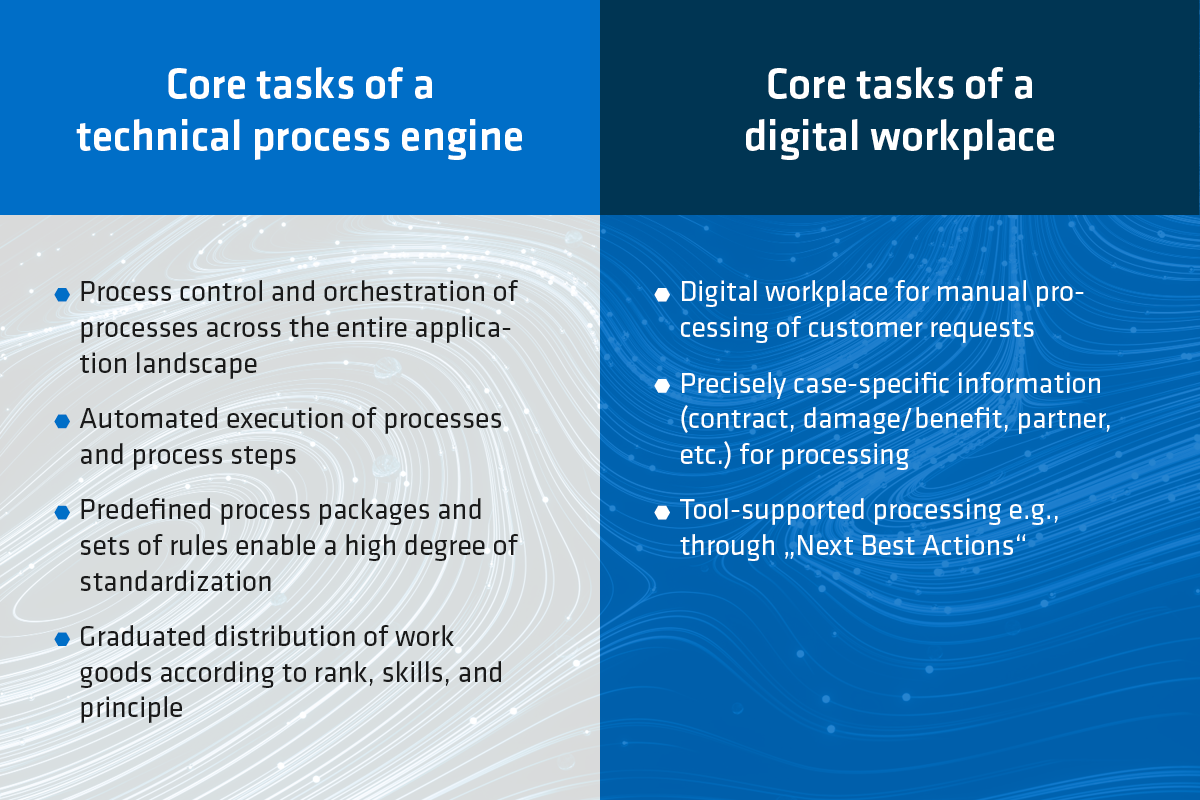

The use of a specialized process engine in conjunction with a digital workstation is ideal for this purpose. By combining the core tasks of these components, customer claims can – on a case-by-case basis – be fully mapped and processed automatically, processed in part automatically and in part manually, or processed entirely manually:

More often than not, insurers are unable to develop their own applications that fulfill and consolidate these core tasks. And in the cases where it is possible, the costs (in terms of both time and money) are exorbitant as a variety of different technologies are used which must be brought together to comprehensively meet the company’s functional requirements. Take, for example, business processes that are modeled in a specialized process engine. A specially developed integration layer is used to integrate the processes into the relevant peripheral systems, while a virtual workstation provides all the necessary functions for the manual processing of customer claims.

in|sure Workflow and in|sure Workplace combine the core tasks of a specialized process engine with a virtual workstation, and thereby allow for reliable end-to-end processes for all the products in the in|sure ecosphere, as well as for the many applications of insurance companies. With in|sure Workflow/Workplace, the processes for handling customer claims can be mapped from start to finish, while the automated processing of claims can be combined with any necessary manual processing. These in|sure tools are also designed to create a high level of standardization. By supplying predefined guidelines and processes, the software allows for most of the necessary guidelines and processes to be standardized, such that only special cases must be customized. What’s more, standard processes, predefined guidelines, and interfaces in the in|sure ecosphere can be updated as required.

The following excerpt from the path of a typical customer claim, processed in part automatically due to a specialized control module, demonstrates how in|sure Workflow/Workplace incorporates all the required capabilities into a single model:

Lots of information is good, relevant information is better

A split screen is provided for the processing of customer claims. In general, data is entered on one half of the screen (e.g., in a specialized system). The other half of the screen displays the customer’s content (e.g., the claim letter). This type of view has proven effective for decades in the claim processing field and is likely to play an even bigger role in the future.

With the shift from “mass” processing based on data entry to specialized processing and customized resolutions, all the relevant information must be made available for processors to make quick and informed decisions. The challenge here is to present the precise information that is needed to make a decision. If too much information is displayed, the relevant content can easily be overlooked. Similarly, if information is missing, then the contract, partner data, or claim cannot be considered in its entirety. Both cases can lead to wrong decisions.

in|sure Workflow/Workplace offers dynamic, built-in, standard views to provide processors with a comprehensive overview and help them make the right decisions:

- Task creation/processing and 360-degree context view

The task creation/processing feature contains all the necessary functions for processing tasks, including in-baskets for the work item, inbox and task assistants for processing customer claims, and (depending on the permissions of the user) extensive monitoring functionalities.

The 360-degree customer view, on the other hand, provides an overview of the data that is relevant to the task processing for each specific case. Among other things, this data can include the partner, contract, and claim information from the respective specialized system. In addition, specialized systems can be called up in the context view to conveniently perform the required steps in the process.

By interacting with the task view, the context view is updated automatically and always displays the precise information that is needed to process the selected task in the workstation. For example, if a contract is modified or an address changes while a task is being processed, then the change is automatically updated in the contract or partner data without the processors having to search for the contract or partner. - Specialized system and document viewer

in|sure Workflow/Workplace offers a second overview comprised of the specialized system and document viewer associated with the respective task. Among other things, the document viewer displays the documents received from the customer. This in turn facilitates the processing of the business processes in the specialized system.

Mass manual data entry is a thing of the past

Like the rest of the work world, the insurance claim processing field is undergoing a major shift. It is moving away from mass, manual data entry to more customized resolutions. To cope with this change, the processes of customer claims must be fully mapped, and if possible, automated on a case-by-case basis. Eventually, claims processors should only be presented with claims that require an expert decision. At the same time, they should be provided with precise, relevant, and comprehensive information to help them make tailor-made and well-informed decisions. in|sure Workflow/Workplace combines the core tasks of a specialized process engine with a virtual workstation, thereby supporting “New Work” in the field of claims processing.

Do you have any questions or comments? Then please leave us a comment.