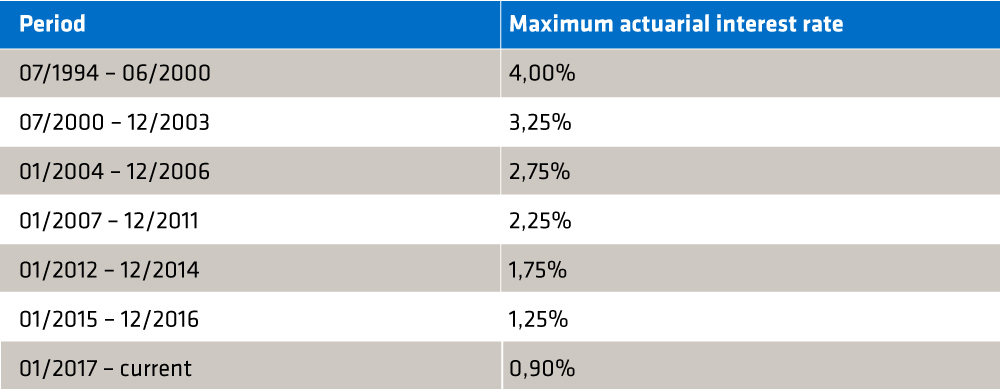

The German Federal Ministry of Finance intends to lower the maximum technical interest rate to 0.25%. The insurance industry uses the technical interest rate as a basis of calculation. The maximum technical interest rate is set by the German Federal Ministry of Finance.

Review – the development of the maximum technical interest rate since July 1994

Background on pension factors

The technical interest rate also plays an important role in the retirement phase of unit-linked pension insurance policies, because it is part of the calculation basis for the so-called pension factors, which usually specify a conversion ratio of saved fund assets to pension.

A figure of € x of monthly pension per € 10,000 of fund assets is common. Depending on the retirement age, the current market level is generally between € 20 – € 30 monthly pension per € 10,000 of saved capital. Simply put, the pension factor represents an exchange rate from money to pension.

For the pension payment period, life insurers make certain actuarial assumptions about, for example, longevity, mortality, interest rates, costs and the gender mix for their portfolios. When doing so, they usually also take buffers into account, since pensions are usually paid over decades and it is not possible to predict, for example, interest rate trends over such a long period of time.

Government cap vs. personal responsibility

For this reason, the German Federal Ministry of Finance is also lowering the maximum technical interest rate, i.e., defining a cap. This provides an imputed threshold value to prevent pension levels being promised that cannot be met later. However, insurers do not have to exhaust this cap, and in practice they have not necessarily done so.

Pension factors vs. guaranteed pension factors

German life insurers distinguish between pension factors at the start of the pension and so-called guaranteed pension factors when drawing pensions from unit-linked pension insurance policies.

Current pension factors are the current “exchange rates from capital to monthly pension” for the current pension start date of unit-linked pension insurance policies.

Guaranteed pension factors are “exchange rates from capital to monthly pension” for deferred pension start dates, i.e., pension start dates for unit-linked pension insurance policies that are still far in the future.

Since the development of technical assumptions, such as life expectancy, mortality, the gender mix in existing and new business, costs and interest rates, cannot be predicted, insurers use buffers to calculate deferred pension start dates in the future. In this way, they can reduce the risk of additional reservations in the portfolio.

In practice, there are two common procedures for determining the guaranteed pension factor. The starting point in this case is either the current pension factors or their calculation bases.

Variant 1:

The guaranteed pension factor is expressed as a percentage of the pension factor when the contract is concluded, where the percentage is usually less than 100%, e.g., 75%.

Variant 2:

Based on the individual calculation components, actuarial and company-specific adjustments can be made in each case. In concrete terms, this may mean that prudent actuaries and business people assume that life expectancies will continue to rise and that insurers will have to pay pensions for increasingly longer periods of time. It may also mean that insurers assume that low interest rates will persist for a long time (the so-called Japan scenario).

This may lead to using a very low interest rate or an interest rate of zero when calculating in order to avoid refinancing risks. If you look at offers or contracts from the English-speaking region, for example, you will see that this is already a common practice there. This approach is more granular, but ultimately only works in a different way by showing a guaranteed pension factor which is usually lower than the current pension factor.

Practical example of guaranteed pension factors

Guaranteed pension factors play an important role, especially in unit-linked basic pensions or Rürup pensions. Why? Because only pension benefits are permissible as a benefit, based on the statutory pension insurance, and the performance of the funds saved cannot be predicted before the start of the pension. This means that insurers can only guarantee a conversion ratio, because there is no guaranteed interest rate for the savings portions and no final guaranteed pension capital.

Of course, there are also unit-linked pensions outside the first layer. However, these usually also have a lump-sum option. The pension capital can then be paid out in full or in part as an alternative to the pension. This somewhat reduces the significance of the pension factors.

Empirical observations

In the past, as soon as the signs of a reduction in the maximum technical interest rate became more apparent, it was observed that a certain final spurt developed because customers still wanted to secure the better capital to pension conversion ratio.

However, after a reduction in the technical interest rate, competitive pressure, increasing comparability and transparency via comparison calculators led insurers to reduce the existing buffers in the other calculation bases in order to mitigate the reduction in (guaranteed) pension factors. This will presumably no longer be the case to the same extent in the future, since on the one hand, these buffers are not available in unlimited quantities, and on the other hand, regulatory expenses such as the additional interest reserve and capital requirements place considerable demands on insurers.

Basically, a convergence of the German calculation bases with the calculation bases of foreign insurers can be observed. For example, when talking to foreign product developers and actuaries in the past, the long-term and high interest rate promises during the accumulation phase and the pension payment phase were found to be quite high by international standards.

Furthermore, some insurers with trustee clauses in their terms and conditions regularly reduce their refinancing risks with the help of trustees. In doing so, they often use the same arguments that have already been used to lower the technical interest rate.

Conclusions

If an insurer uses the currently valid maximum technical interest rate when calculating pensions, any reduction in the maximum technical interest rate will ultimately lead to a reduction in current pension factors, and indirectly, to a reduction in guaranteed pension factors, all other things being equal. However, this generally only affects new business and not the portfolio, unless the trustee clause is used in the portfolio.

The adjustment of the maximum technical interest rate as an imputed cap prevents upward market distortions and, from experience, regularly creates expenses and costs for life insurers. For example, new rate generations are then reintroduced, and these must then be accrued accordingly. For example, updated calculation engines are then also needed. Web services must be updated and properly integrated by comparison calculators. Of course, this also involves various testing costs. We would be happy to support you in this process.

If you would like to learn more about the cost-efficient management of life insurance portfolios with a short time-to-market, please contact our life insurance expert Stephan Muens.

Do you have any questions or comments? Then please leave us a comment.