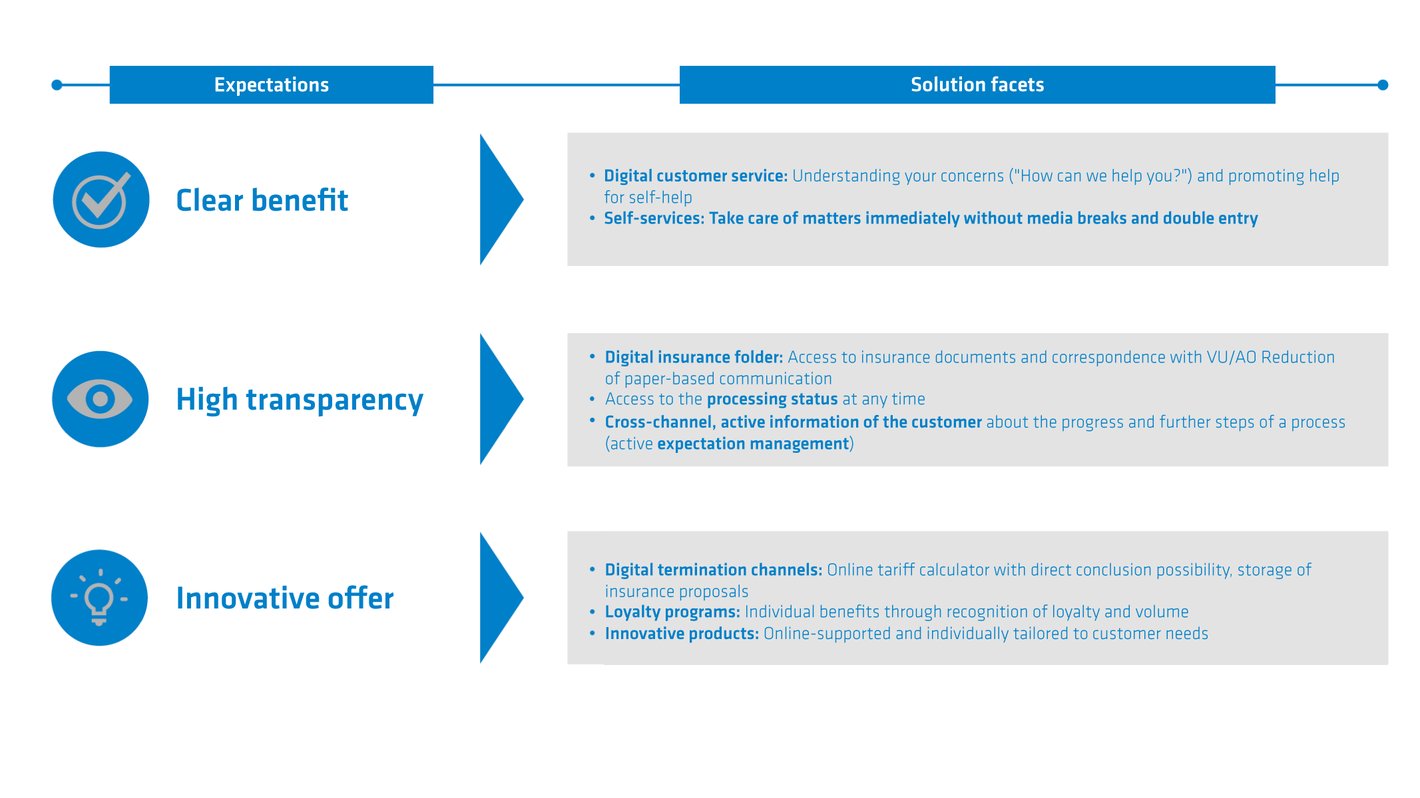

There is no longer any question as to whether or not insurers will support digital processes in the future. In almost all areas of life, most customers now expect an online communication channel for their transactions. Insurance customers are no exception. Today, customers not only evaluate the willingness of insurers to provide the contractually agreed benefits for insurance claims, they're also interested in the “surrounding” services. The resulting challenges are many and varied:

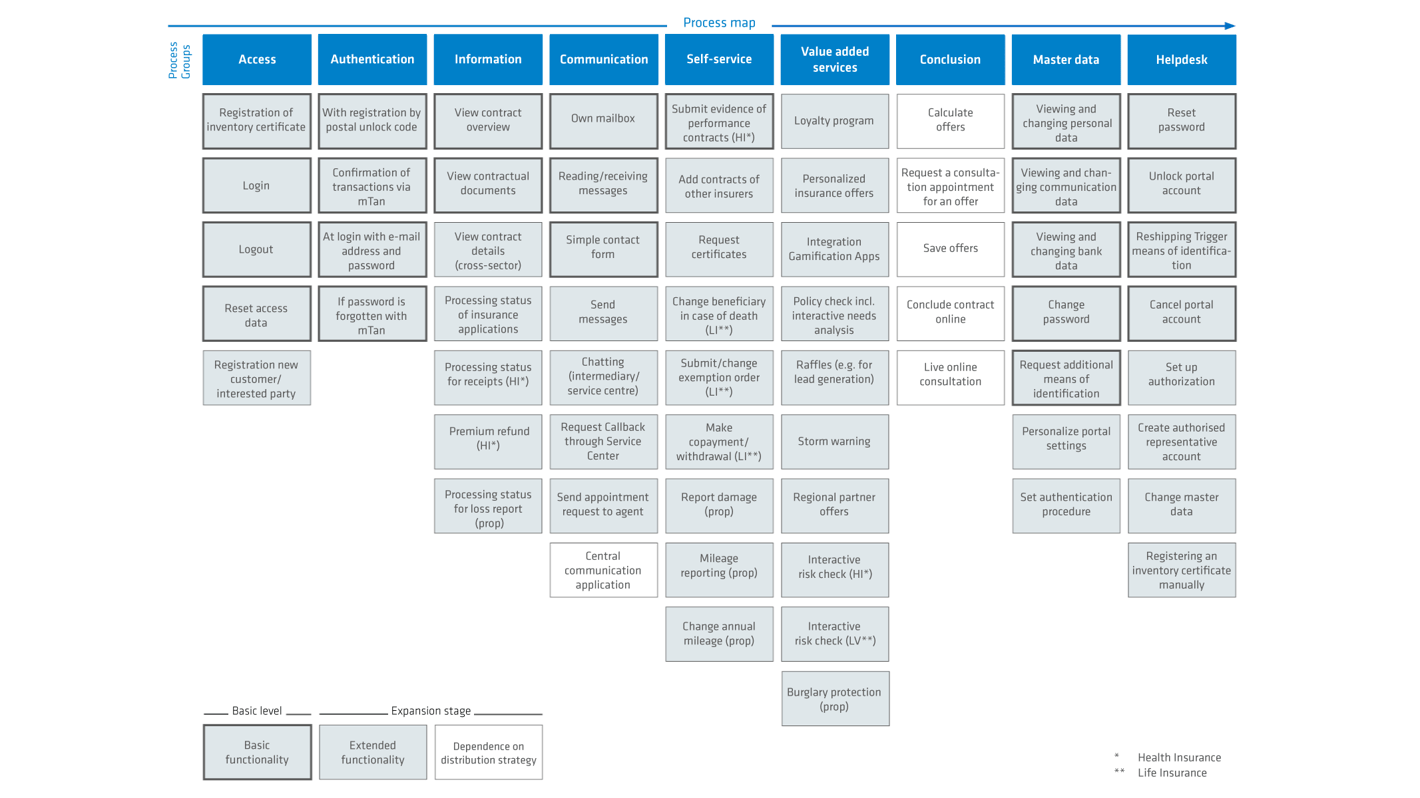

The following overview summarizes the processes and applications that can be mapped with a modern customer interface today. Of course, these can be expanded indefinitely:

Now, the question for underwriting departments is how best to proceed. One thing is clear: The customer interface should be attractive, optimized for mobile applications (in other words: Mobile first!), developed with modern surface technology, and above all, it should offer genuine added value. If you don't have the opportunity to set up a new company and "break new ground," as is currently the case in some divisions, then at some point, you'll have to begin at the interface between the company's current application landscape and the new super app.

Option 1: "The Potemkin village"

Digital customer interfaces, which we shall refer to as apps for the sake of simplicity, look beautiful and offer all kinds of features. Unfortunately, however, most apps at some point are likely to suffer an internal media disruption. A claim form with a geographic information service and an interactive claim designer is converted into a PDF after the (customer's) work is done, ideally enriched with some customer master data in XML format in order to at least lend some small measure of support to the claim handling process. Customers can also use a form or request a certificate in order to change their address and to update their bank details. Unfortunately, almost nothing happens in the background. An entry is created in the inbox system and the "process" is sent to a clerk in the contracts or benefits department, who adds it to the queue, where it usually waits a little while longer before finally being completed.

The advantage is that you quickly present yourself to the market with a fancy app and show that you haven't forgotten the customer during the digitization process.

The disadvantage is that customers are developing an increasingly better awareness of real networking and bi-directional processes and you can quickly be exposed for "cheating." So, it's best not to let the gap between what you wish for and reality become too wide...

Option 2: "Engine capacity instead of external details"

Nothing is presented to the customer that has not been wired in the back end systems for fully automated interactive communication. In case of doubt, this means that only "unstructured" communication is used and free text fields for message transmission characterize the digital face of the insurer for at least the time being. Nothing happens for a while, because digital conversion takes time. However, there are no false expectations created by non-existent automation.

Simply lecturing does not seem to lead to any success here. In most cases, a hybrid, responsible, resource-conscious adaptation to the options available in the company will remain the method of choice. However, you don't have to forego all the features of a modern customer interface, if you manage expectations. Where something cannot yet be processed in the background, for example, when issuing a certain certificate or changing an address, you can write a short email asking the customer to be patient while waiting for the processing to be completed. Many companies still find it difficult to be so transparent.

At the same time, the customer interface - just like the connection to agents and claims partners - is a nice touchstone for a company's IT architecture. In modernization projects (in the case of real online services), the question of how communicative the systems used for partner administration, policy management and claims management should be is of great importance, even more so than the question of how attractive the interfaces for processing claims should be for your own employees.

Do you have any questions or comments? Then please leave us a comment.