In our blog, we take a look at developments in life insurance on a regular basis.

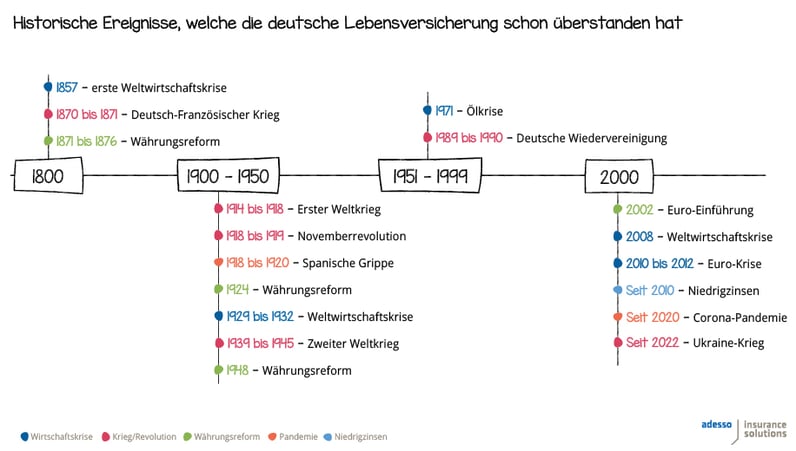

Together with Versicherungsforen Leipzig, we published an up-to-date study to coincide with the 10th anniversary of our policy management software for life insurance in|sure PSLife The study makes one thing clear: Life insurance has a future in Europe. And not only because it has already outlasted many events in its long history.

Our study "Business Model Life Insurance 2025 to 2030 : A European Perspective," forecasts the continued development of the business model over the next five to ten years and lets national and international experts in the industry have their say.

Drivers of change

There are a number of political, economic, environmental, and technological factors that can be identified as drivers of future change in the life insurance business.

The persistently low interest rate environment is likely to continue to drive life insurers to innovate in the coming years. Traditional products are becoming less attractive to customers. In the biometrics business, on the other hand, there is further market potential.

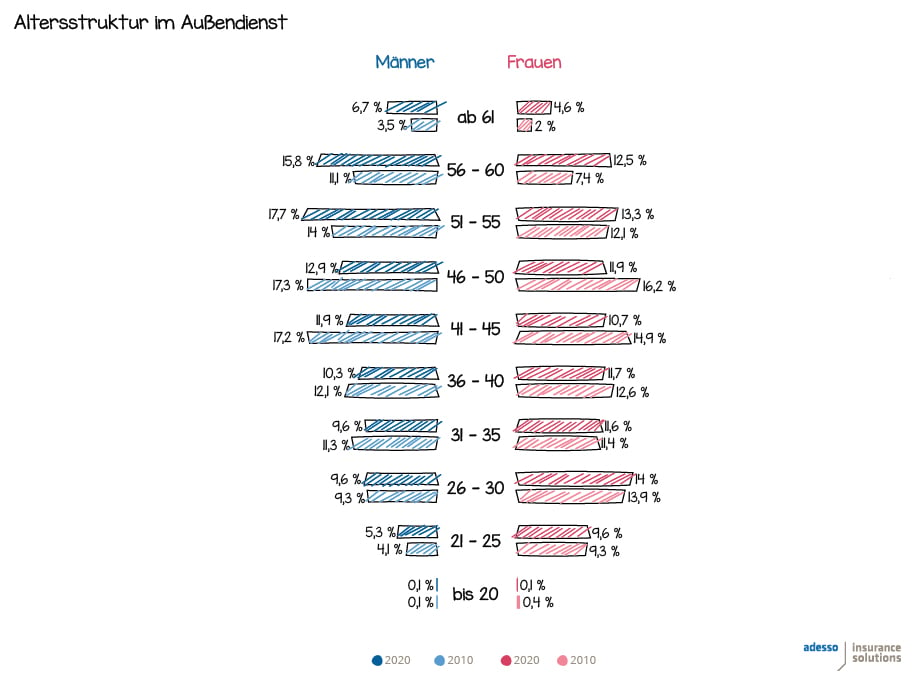

As an additional economic factor, the demographic development in sales is relevant. In Germany, "the sales force" is getting older and older, and is retiring without there being any clear picture of who will take its place. For the next generation, the insurance industry no longer seems like an employer that has enough appeal.

As an ecological factor, the topic of sustainability has also gained relevance for insurers in recent years. From August 2022, the implementation of ESG obligations in both the advisory process and product development will be mandatory by law.

Neo-brokers are becoming increasingly relevant within the market. Transparency, flexibility, and digital access channels are making the products more attractive in comparison with those found in regulated life insurance. Since the beginning of the COVID crisis, nearly three million people have newly entered the insurance exchange, of which a good one million are younger than 20 years old.

Effects on the market

These drivers can have a number of implications for the life insurance business:

In the future, the market will be dominated more by biometric products and unit-linked policies without guarantees. In the case of unit-linked products, a large part of the market risks can be passed on to the policyholders. The expansion of the biometric product portfolio leads to a strengthening of the insurer's economic equity through the priced-in margins.

The importance of company pension plans will continue to grow. One difference can be seen in the pension systems of European countries: The proportion of those who do not provide for their old age ranges from 10% in Sweden to 60% in Finland. There is still a lot of potential here.

Digitilization is changing consumer behavior

In addition, the consumer behavior of customers is changing. Traditional insurance sales have been increasingly competing with digital sales channels since the COVID pandemic began, if not earlier. In addition, there is a trend for brokers to act more in an advisory capacity and less in a sales-oriented manner in the future.

The level of digitization in life insurance is still low compared to other branches and industries, but in the future we can expect to see more digital, lean, flexible, and understandable products on the market that have no acquisition costs.

Niche products geared toward specific target groups have been found here for some years now, e.g. term life insurance for certain sports or pension plans for specific occupational groups. This trend will continue.

More and more life insurance portfolios are being transferred to run-off. The continuing low interest rate environment and ongoing regulation will lead to a consolidation of the market, especially in Germany.

Six promising business models

The effects outlined above result in various business model approaches that affect the existing specialist areas within insurance companies to varying degrees. In some cases, they can today already be found in several markets. The models vary across European countries, but can be divided into six different clusters.

- Cost leader

- Ecosystem provider

- Ecosystem supplier

- Asset Manager

- Biometrics products or health partners

- Target group insurer with a niche focus

There are enough opportunities

The multitude of factors that are causing a change in the life insurance market are not only creating challenges for insurers, but opportunities as well.

For example, the increasing alignment in European regulation means that business models can increasingly be adapted and deployed across national borders.

Insurance companies can develop a promising strategy for success by focusing on their own competencies and niches.

The projected business models offer opportunities for an insurance company's continued development. They serve as a point of reference for aligning the company's own strategy and future viability. To this end, the study takes a look at other countries and interviews actuaries. In particular, they considered the business models of target group insurers, asset managers, and ecosystem providers to be future-proof.

You can download the German-language study here.

Download the press release here: https://www.adesso-insure.de/en/news

Do you have questions about the study? Then please feel free to contact us by email.

Do you have any questions or comments? Then please leave us a comment.